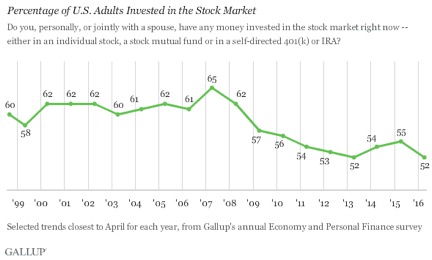

And it is even worse for the Millennials. Only 38% of this group owns any stocks. How will they retire? They won’t.

How Much Do You Have To Set Aside To Retire (In Comfort)?

How can the average American ever retire with interest rates at 2% or 3% and falling. If a family were somehow able to scrimp and save a million dollars, they would only receive $20,000 to $30,000 a year - before taxes on a safe interest-bearing investment like a bond or CD. Can you retire on that amount? And how many Americans do you think have saved a million dollars? Sure, you can add another $20,000 from Social Security payments and that ups the number to around $50,000 or so but that is a life style without vacations, without new cars, and one that hopefully does not have to deal with expenses from a major illness. How many Americans can afford long-term care insurance? Not many.

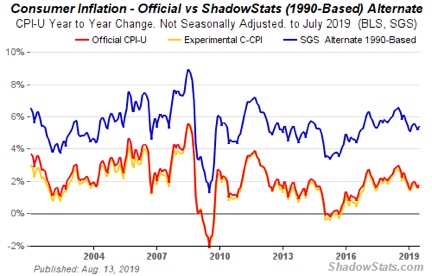

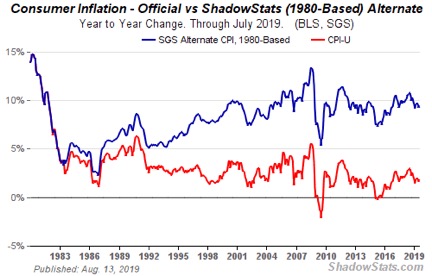

You may be one of the fortunate few who are situated well above these numbers. Many of our readers probably are, but even we are getting squeezed and our dollars are not going nearly as far as they used to. I’m on my third Porsche Carrera in the last 10 years and the cost has risen by nearly $20,000 for the same car. What would the BLS have to say about that? They would say I can drive a Chevy. Both are cars, so the cost has not gone up at all. That’s what they do when they “adjust” inflation “hedonically.” The computing power of your Apple computer doubled so the fact that the price may have also doubled is deemed to be of no consequence. And if the price of steaks rises, then you will eat chicken. See, no inflation. What you get is deflation – deflation in your standard of living.

The What and the Why

That is the WHAT. But I like to talk about the WHY. Being in my industry has answered the “WHY” question. “WHY” our standard of living is shrinking before our eyes. And when you understand the “WHY” you understand why people buy gold and silver.

Forget about what gold did today, or last week, or last month. Gold is not about “price and it is not about profit.” Gold is about being able to maintain buying power - over time. Please don’t accuse me of deliberately picking a time frame that is favorable to gold. Almost any time frame of a couple of decades or more would suffice. But I will use 1970 as a fair starting point for this discussion. Gold was the official backing of the dollar until 1971.

In 1970 I went to work for Target Corp. as an assistant buyer at a starting salary of $8,000 a year. A senior buyer at Target might make twice as much. Lou Kennedy, the toy buyer, told me, “My goal is to make $1,000 a year times my age.” In other words, when he was 25 he wanted to make $25,000 a year and when he was 40 he wanted to make $40,000 a year. That was a far-reaching goal in those days. It hardly seemed possible.

In the late 60s I built a lovely four bedroom colonial house in a new suburb for $32,000 and bought a new canary yellow Corvette convertible for $3,500. Then I moved up to a red Mercedes 280SL roadster for $9,000. (This was all pre-Target when I was making a lot more money.) An ounce of gold officially sold for $42.22, but you couldn’t legally buy it. It was illegal to own gold until 1975. In a few short years, gold exploded to $850 an ounce as inflation raged on – the result of the Viet Nam war and Lyndon Johnson’s social programs. In the 70s, rampant government did cause price inflation. These days, with trillion dollar plus annual deficits, they tell us debt doesn’t matter.

The “official” BLS rate of inflation since 1970 states it now takes about $6.50 to equal one 1970 dollar. So let’s revisit the prices I listed above and see if they are lying. Of course they are, but let’s check just for kicks.

My 1970 wage of $8,000 would be adjusted to $52,000. My house in the suburbs would be adjusted to $208,000. A new Corvette would now cost $22,750 and the Mercedes roadster would cost $58,500. I would estimate that my taxes have more than doubled, so you could calculate that in too, which would significantly reduce the net amount I had to pay for these things but whose counting?

The price of a house like the one I built in 1968 for $32,000 now runs around half a million (not $208,000). A new Corvette starts at $56,000 (not $22,750) and a Mercedes roadster comparable model to my 280SL world run $114,500 ( not $58,500). As my friend Backwoods Jack loves to say, “Confucius say Sum-ding-wong.” What’s wong is the CPI, which simply stated is a fraud.

Who Cares If Inflation Is Under Stated?

So who cares? It’s just a number right? Wrong. Our Social Security checks are indexed to the way-understated number. If inflation were officially acknowledged to be 6-10% guess what would happened to wages and guess how much interest the banks would have to pay you for your deposits? We are being lied to and screwed. And since gold is the Canary In The Mine Shaft, when its price rises too fast it signals inflation. Interest rates rise. Is it any wonder that the powers-that-be do everything they can to suppress the price?

Let’s Price Things In Gold Ounces

O.K. how about another example, one that is more recent. In 2005 Susan and I took out a $1,100,000 mortgage on a house we built in a lovely part of Minneapolis. I had a choice to make. Should I pay cash for the house and not have a mortgage, or should I keep the money and let the bank do the financing? At the time, gold was $500 an ounce and between my physical gold holdings and mining shares I could have cashed them out and paid for the house. It would have taken 2,200 ounces of gold to cover the cost of the house. I chose not to sell my holdings and instead took out the mortgage. Was that a good decision? Today the 2,200 ounces of gold is worth $3.3 million. It turned out to be a very wise financial decision.

The simple fact is – the government can’t print gold and the way things are headed with trillion dollar plus annual deficits,a $21 trillion dollar national debt, the debt ceiling recently eliminated; the amount of new money that needs to be created will accelerate inflation as far as the eye can see. I can see the 1970s all over again, especially if this administration gets us involved in another war in the Middle East. As inflation causes the dollar to lose purchasing power, the price of gold appears to rise, when in fact it does not – it just takes more dollars to buy the ounce of gold. Yes, gold does what it is supposed to, it preserves buying power over time. Most of my friends do not understand that and most of them do not own any gold. They think I am nuts. I think they are misguided. Only one of us is right.

Bill Murphy says it’s only a matter of time until the Cartel can no longer source enough physical gold to keep the price under wraps. What is unusual is that gold has rallied without much help from the dollar. There is a new buyer out there with deep pockets.

Posted

by

The Blogger

* * * * *

No comments:

Post a Comment