HURRICANES AND THE WAR ON CASH!

This article in its entirety was imported from GSI Exchange, which can be found on the internet.

They are a precious metals dealer.

The blogger has no business relationship whatsoever with GSI Exchange, but from time to time does receive newsletters and articles from them as a matter of interest and education.

The following article is presented here for INFORMATIONAL PURPOSES only. It shows, how in times of absolute disaster, governments can not only be irrelevant and totally useless, but even become the most brutal of dictators to the detriment of the population. Please read and absorb the material here presented.

The next disaster that happens could be where YOU are, and it is always smart to have an understanding of the problems and what the possible solutions might be....

Here is the article:

Brutality of Cashless U.S. Exposed by Hurricanes

The recent hurricanes that devastated parts of the US and its territories exposed a sobering truth–their destructiveness came in two distinct forms: one natural, the other artificial; one, a convergence of natural forces, the other, a convergence of political agendas; one, an “act of god,” the other, a product of government.

The difference: the physical destruction wreaked by the hurricanes proved finite, while the socio-economic destruction inflicted by government policies proved generative, systemic, and forward-looking.

Two Hurricanes and Two Policies

The problem with unintended consequences in the realm of government policy is not just that their range of harm can be frighteningly asymmetrical, as in the case of Irma and Maria, but that they are easily detectable–their potential for damage logically calculable–yet often ignored by the masses.

Hurricane Maria’s effects worsened by the War on Cash

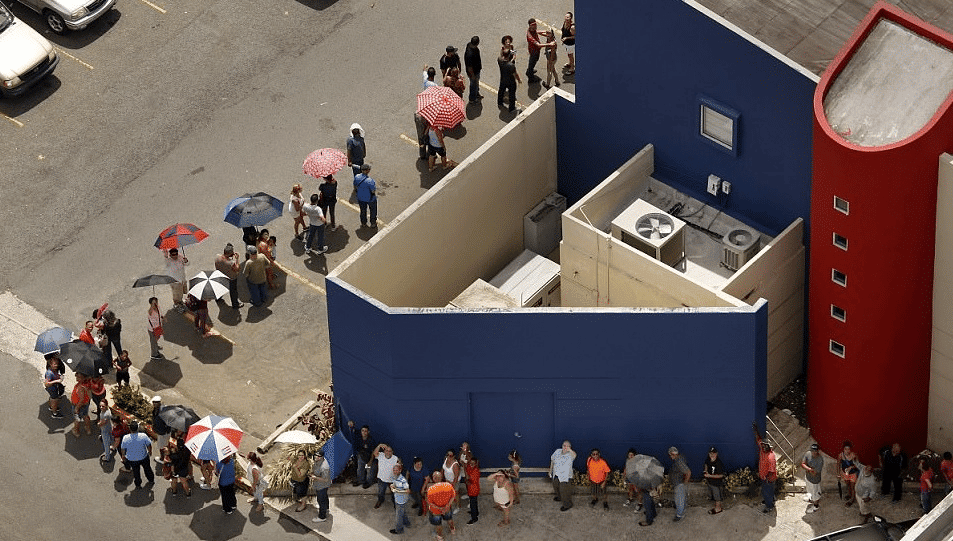

Commerce in San Juan, Puerto Rico began showing signs of life earlier this week, just several days after being hammered by Hurricane Maria. Shops and street vendors once again opened up for business, providing basic necessities for day-to-day living.

There was only one problem, however, and a major one at that: almost every vendor accepted cash only, and it was nearly impossible to find any shop that accepted credit cards. “Cash only” signs abound throughout cities plagued by severe cash shortages.

Many of the citizens were surviving off cash they withdrew before the storm. Due to power outages or just a lack of capacity for cash replenishment, most of the ATM’s were no longer in operation. Bank withdrawals were the only option, yet even that option was discouraging, as bank lines were extremely stretched, such as the case of Banco Popular (Puerto Rico’s largest bank) in San Juan, whose line upon opening last Monday was 200 deep.

What does this have to do with the war on cash? Puerto Rico has been seeking numerous solutions to reduce its debt which had exceeded $70 billion. Part of that solution is to collect any form of money that slips between the cracks. Money that can be monitored and controlled, such as electronic payments and credit card transactions, are easy targets for taxation and collection. Cash, on the other hand, can often escape detection to a relative degree, making it difficult to tax or seize.

Perhaps for this very reason, the cash culture thrived, particularly among small businesses refusing to accept credit card purchases. Although this was not the case for larger businesses and vendors, the devastating impact of a cashless society is now being felt across all businesses in Puerto Rico, as cash is the only viable means of exchange available to the masses.

Although the value of fiat currency poses another problematic issue, the fact remains that in particular societies, such as Puerto Rico, cash happens to be the only practical means of exchange.

And for government to initiate efforts toward establishing a cashless society, such efforts would not only risk the loss of transactional privacy and freedom, it would risk crippling itself, as the crisis in Puerto Rico has shown.

Hurricane Irma and the War on Transactional Freedom

In hurricane-devastated Green Cove Springs (FL), food supplies were desperately needed as stores and restaurants were largely shut down. Jack Roundtree, a food truck owner and good Samaritan, decided to take a portion of his profits to provide utility workers free meals.

Local government officials, upon hearing about Roundtree’s charitable deeds, called the police to shut down his operation. Why? Roundtree hadn’t yet paid the local government for the privilege of performing what most would consider a basic act of neighborly compassion and decency: feeding a fellow human. He didn’t have a permit. Upon arrival, the police told Roundtree to pack up and leave.

Privileging bureaucratic policy over human need

Such a policy is analogous to the concept of a cure that’s worse than the illness. In this particular case, not having to mention the common sense understanding that policies don’t starve–people do, the requirement to hold a permit performed a “protective” function (food safety) but to the detriment of the people it was meant to protect.

The irony is that Roundtree was asked to leave because he failed to purchase a permit from city hall; yet city hall was closed because its workers were too busy tending to certain needs which Roundtree was trying to serve.

Instead of allowing Roundtree to feed people first and obtain a permit once government workers had returned, local authorities decided to place bureaucratic policy over people’s “human” right to obtain food.

The bottom line is that Roundtree came up against a regulation that used “public safety” as a facade to conceal its real agenda: to raise government revenue and limit competition for established local food vendors.

The aftermath of Irma and Maria gives us a glimpse at what can happen if we fail to critically question the motives and consequences associated with policies erected in the name of efficiency (cashless society) and public interest (over-regulation).

The takeaway: any government regulation that limits transactional freedom and privacy in the interests of the greater good only serves to strengthen government at the cost of harming and subjugating its own people.

End of article.

Something to consider. Remember that India recently banned cash. It caused a huge disruption in Indian Society, from which the country has not yet recovered.

Posted

by

The Blogger

No comments:

Post a Comment